The PayFi Report 2025 (Mar)

In March, PayFi continues to be a hot topic in the market. We are rapidly advancing towards this next-generation financial paradigm that integrates crypto payments with DeFi. Building this promising vision won't happen overnight, it requires the collaborative efforts of multiple parties and timely catalysts.In this March PayFi report, we will explore the market situation and identify the catalysts that will propel us towards the PayFi financial paradigm. Data Tells First, let's examine the st

In March, PayFi continues to be a hot topic in the market. We are rapidly advancing towards this next-generation financial paradigm that integrates crypto payments with DeFi. Building this promising vision won't happen overnight, it requires the collaborative efforts of multiple parties and timely catalysts.In this March PayFi report, we will explore the market situation and identify the catalysts that will propel us towards the PayFi financial paradigm.

Data Tells

First, let's examine the stablecoin supply data. According to DeFiLlama, the supply increased from 224 billion in February to 234 billion in March. With the continual growth of stablecoins, the stablecoin supply market has steadily increased from 130 billion in January 2024 to its current level.

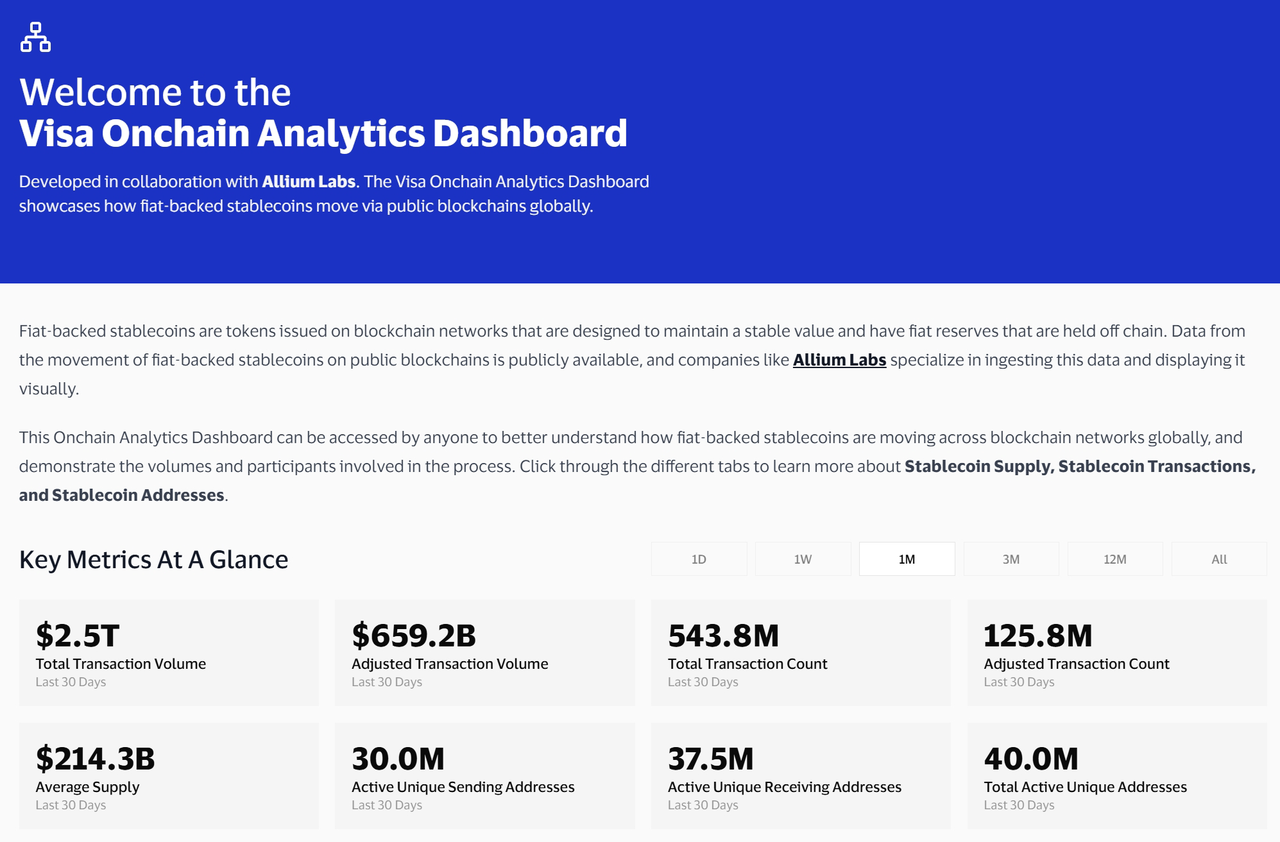

Analyzing Visa's data and comparing the statistics from January and February, it is evident that the overall decline in the crypto market has also impacted stablecoin trading volume in March. Excluding data from high-frequency transactions and bots, Visa-adjusted stablecoin figures indicate that overall trading volumes remain comparable to February, with a slight uptick in the number of user addresses.

The market environment has remained unchanged since the downturn in January, as it continues to await a significant catalyst to invigorate the market. The primary impetus in March stemmed from signals released by U.S. regulatory policies.

Catalyst I: Regulatory Clarity

The ongoing debate over stablecoin legislation in the U.S. brings attention to the Guiding and Establishing National Innovation for US Stablecoins Act of 2025, known as the Genius Act. This proposed legislation seeks to regulate stablecoins by creating the first comprehensive regulatory framework for their issuance and oversight. Having received strong bipartisan support in committee, the bill is well-positioned for full Senate approval. Meanwhile, French Hill (R-AR), Chair of the U.S. House Financial Services Committee, is set to promote a similar initiative, the STABLE Act.

Furthermore, President Donald Trump has indicated his willingness to sign stablecoin-focused legislation. Influential voices such as Elon Musk have joined the conversation, highlighting the broader discourse on the future of digital currencies and their regulation. This discussion emphasizes the necessity of a robust regulatory framework to ensure stability and trust in the rapidly evolving digital currency sector, with expectations that stablecoin legislation may become law later this year.

The Office of the Comptroller of the Currency (OCC) has declared that various cryptocurrency activities are now allowed within the federal banking system, as outlined in Interpretive Letter 1183. This letter authorizes national banks and federal savings associations to engage in crypto-asset custody, certain stablecoin activities, and participate in independent node verification networks like distributed ledger technology, removing the previous requirement for OCC-supervised institutions to obtain supervisory nonobjection and demonstrate adequate controls.

The Federal Deposit Insurance Corporation (FDIC) issued Financial Institution Letter (FIL-7-2025), providing new guidance for FDIC-supervised institutions engaging or seeking to engage in crypto-related activities. This new guidance clarifies that these institutions may engage in permissible crypto-related activities without prior FDIC approval. The guidance allows FDIC-supervised institutions to partake in activities involving new and emerging technologies such as crypto-assets and digital assets, as long as the associated risks are adequately managed.

From PolyFlow's perspective, the recent U.S. banking regulators' move plays a crucial role in integrating cryptocurrency activities into the traditional banking framework. Recent actions are seen as transformative, reducing the regulatory burden on banks and ensuring consistent treatment of crypto activities. By addressing crypto-asset risks, the U.S. banking regulators' initiatives are set to revolutionize how banks interact with digital currencies, marking a significant shift in the financial landscape.

Catalyst II: Wall Street Giants' Skin in the Game

Fidelity Investments is preparing to launch its own stablecoin, tentatively named "Fidelity Token" (FT). The move marks a significant step for the investment giant as it seeks to expand its offerings in the digital asset space. The introduction of FT aims to provide a stable and secure medium of exchange, leveraging Fidelity's reputation and experience in traditional finance. This new development is part of Fidelity's broader strategy to integrate blockchain technology and digital assets into its services, highlighting the growing convergence between traditional financial institutions and the cryptocurrency industry.

Since the launch of RLUSD earlier this year, Ripple has started integrating this new stablecoin into its cross-border payment solutions. This initiative is designed to enhance the efficiency and reliability of international transactions on Ripple's platform. By incorporating RLUSD, Ripple aims to offer a stable and secure transaction medium, further strengthening its position in the global payments landscape. This move underscores Ripple's continuous efforts to innovate and streamline cross-border payments, utilizing stablecoin technology to lower costs and increase transaction speeds for its users.

Circle's recent IPO filing is set to test the confidence of the crypto market following the shockwaves caused by tariffs imposed by the Trump administration. The filing represents a significant development for Circle, a major player in the cryptocurrency space, as it seeks to go public. This move comes at a time when the market is still grappling with the economic impacts of the tariff announcements. Circle's IPO will serve as a barometer for investor confidence in the cryptocurrency sector amidst these challenging economic conditions.

From PolyFlow's perspective, following the U.S. regulatory shift towards a pro-crypto stance, U.S. financial institutions have increasingly ventured into the cryptocurrency space. Although BlackRock has yet to announce its own stablecoin initiative, its involvement is evident in several recent crypto developments. Fidelity Investments is another financial giant entering the stablecoin market, following in the footsteps of PayPal. Meanwhile, Ripple has taken the lead by gradually developing application scenarios for its RLUSD stablecoin. Notably, Circle is progressing toward its IPO. Consequently, the entry of Wall Street financial heavyweights serves as another catalyst for the industry.

Catalyst III: Investment Trend

Mesh, a crypto payments firm, has successfully raised $82 million in Series B funding amid soaring stablecoin adoption. The round, led by Paradigm, with participation from Consensys, QuantumLight Capital, Yolo Investments, and others, brings their total funding over $120 million, highlighting the growing confidence in using stablecoins for digital transactions. This significant funding round demonstrates the increasing momentum behind Mesh's vision to enhance digital transaction experiences with innovative payment solutions. The capital will be crucial in expanding Mesh's operations and integrating stablecoins into everyday financial activities, cementing its position as a strategic player in the rapidly evolving crypto payments landscape.

Notably, what makes this fundraising historic is the manner in which it was conducted. A significant portion of the investment was settled using the PayPal USD (PYUSD) stablecoin. Mesh utilized its technology to facilitate the transaction, providing a firsthand demonstration of the capabilities they are developing.

Redotpay has secured $40 million in Series A funding to accelerate its global crypto payment solutions, allowing the company to expand its reach and enhance its services, thereby positioning itself as a key player in the global crypto payments landscape. This significant investment reflects investors' confidence in Redotpay's vision to innovate and streamline digital payment processes across various markets. With the newly acquired funds, Redotpay aims to accelerate its product roadmap, enhance its payment ecosystem for a smoother user experience, strengthen regulatory compliance frameworks, and broaden its licensing footprint across multiple jurisdictions.

Stable Sea has secured $3.5 million in funding to enhance its global stablecoin offramping solutions. This investment will enable Stable Sea to expand its services, making it easier for users worldwide to convert stablecoins into fiat currency. The funding underscores investors' confidence in Stable Sea's vision to streamline the transition between digital and traditional currencies, thereby facilitating broader adoption of stablecoins in global financial markets.

Abound, a company spun out of Times Internet, has raised $14 million to facilitate easier remittances for Indian-Americans sending money back home. This funding round will help Abound expand its services, making it more convenient and efficient for the Indian diaspora in the U.S. to transfer money to family and friends in India. The investment reflects the growing demand for streamlined financial solutions in the remittance market, enabling quicker and more affordable transactions across borders.

The Trend in March

The market hasn't seen much change, and the entrepreneurial and investment environment is striving to bridge fiat currencies with cryptocurrencies. However, there has been a significant shift in the regulatory landscape.Policymakers are currently working on establishing rules to acknowledge and regulate stablecoins in a way that maintains financial stability, protects consumers, and encourages innovation. The current Genius Act, which aims to clarify these regulations, could potentially facilitate broader adoption and integration of stablecoins into the global financial system.

About PolyFlow

PolyFlow is an innovative PayFi protocol designed to connect real-world assets (RWA) with decentralized finance (DeFi). As the infrastructure layer of the PayFi network, PolyFlow integrates traditional payments, crypto payments, and DeFi in a decentralized manner to handle real-world payment scenarios. PolyFlow provides the necessary infrastructure to ensure compliance, security, and seamless integration of real-world assets, paving the way for a new financial paradigm and industry standards.

SOCIALS

To find out more about PolyFlow and keep up with our latest developments, follow the official channels.

📣Mirror | 💬 Global Community | 👾 Discord| 🐦 Twitter/X | 🌐 Website

CONTACT US

support@polyflow.tech

Interview with PolyFlow CFO: When Payments Build Onchain Credit — PayFi Reconstructs Financing

In the traditional financial system, “payment” is often regarded as the end state of value transfer. But in the world of PayFi, it marks the beginning of value creation. When Visa can process tens of thousands of transactions per second but still requires several days for cross-border settlement, and when small and medium-sized enterprises shoulder a 6.5% cost on international payments while still having to pre-fund transactions, a financial revolution is quietly fermenting through on-chain paym

PolyFlow Insights: Rethinking Financial Systems Through Blockchain

The article is sourced from the Forbes Finance Council. Original article link: https://www.forbes.com/councils/forbesfinancecouncil/2025/03/28/drawbacks-of-traditional-financial-systems-and-how-blockchain-tech-can-help/ Raymond Qu | Cofounder PolyFlow, aiming to transform the global payment landscape & create efficient, innovative pay solutions | Geoswift. The traditional financial system has long been the backbone of global commerce, enabling economic growth. However, despite its many strengt

The PayFi Report 2025 (Mar)

In March, PayFi continues to be a hot topic in the market. We are rapidly advancing towards this next-generation financial paradigm that integrates crypto payments with DeFi. Building this promising vision won't happen overnight, it requires the collaborative efforts of multiple parties and timely catalysts.In this March PayFi report, we will explore the market situation and identify the catalysts that will propel us towards the PayFi financial paradigm. Data Tells First, let's examine the st